Dabaiba addresses the Central Bank of Libya's governor with comments on revenue and expenditure data.

Pulbished on:

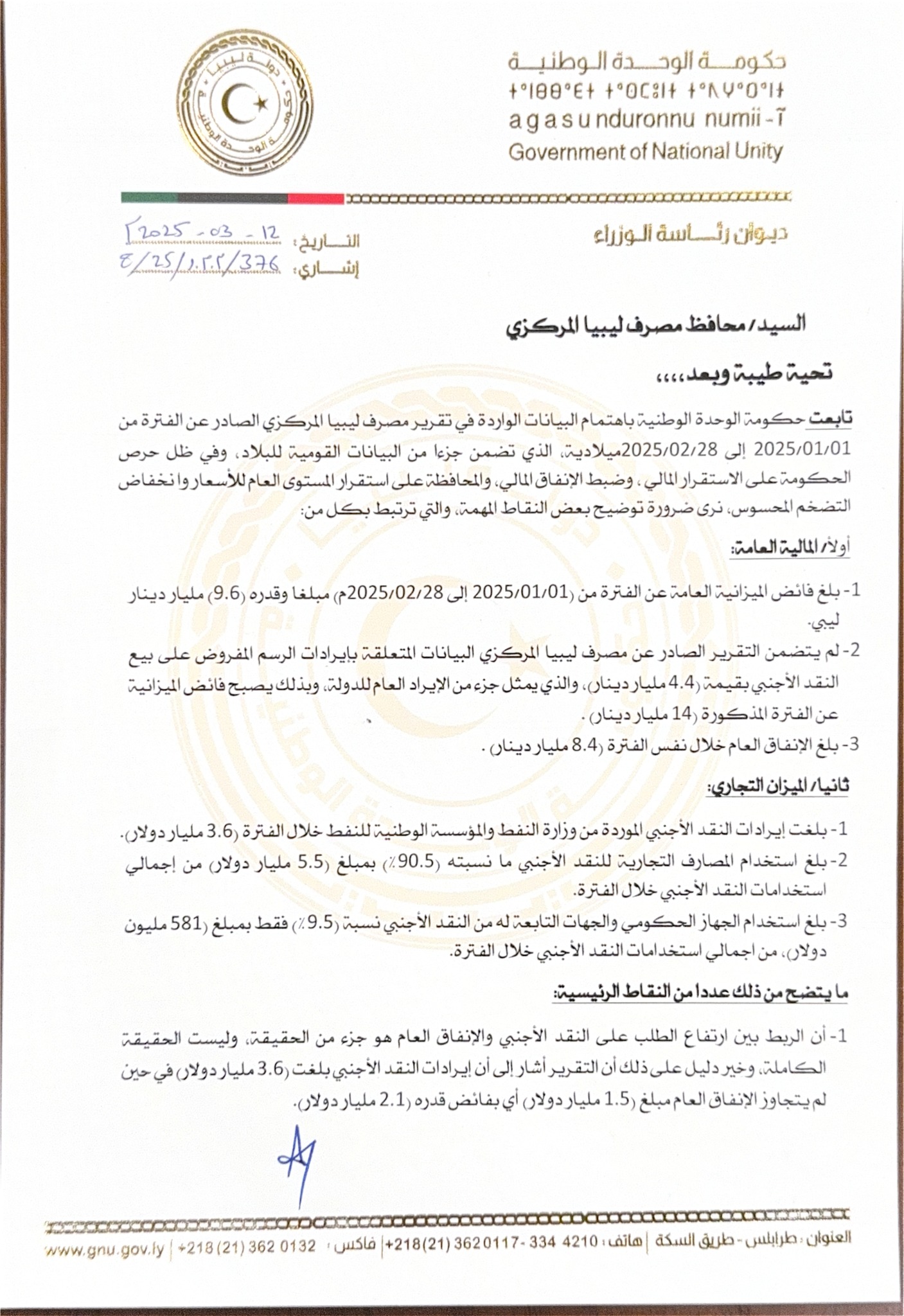

Tripoli, March 13, 2025 (LANA) - The Prime Minister of the Government of National Unity, Abdul Hamid Dabaiba, addressed a letter to the Governor of the Central Bank of Libya, Naji Issa, expressing his observations regarding the data contained in the bank's report on revenues and expenditures for January and February 2025.

According to the government's media office, Dabaiba referred in his letter to the bank's data, which showed a general budget surplus for the two months amounting to 9.6 billion Libyan dinars. However, the Central Bank's report did not include data related to revenues from the fee imposed on the sale of foreign currency, amounting to 4.4 billion dinars, which represents part of the state's general revenue. Thus, the budget surplus for that period amounted to 14 billion dinars.

Regarding foreign exchange, total revenues during that period amounted to $3.6 billion, while total uses and outstanding liabilities in foreign exchange amounted to $6.1 billion, distributed between uses amounting to $581.6 million through the Central Bank of Libya and $5.537 billion through commercial banks, according to Dabaiba's speech.

Dabaiba stated that the link between the increase in demand for foreign exchange and public spending "is part of the truth, but not the whole truth." He demonstrated this by stating that the report indicated that foreign exchange revenues amounted to $3.6 billion, while public spending did not exceed $1.5 billion, representing a surplus of $2.1 billion.

He also pointed to the continued emergence of a temporary trade deficit in the country's trade balance, estimated at approximately $2.5 billion over the two months, which is directly linked to money creation in the economy.

He stated that the significant increase in demand for foreign currency during the last quarter of 2024, and the months of January and February (2025), at unprecedented rates, "raises questions that require further disclosure of the sources of funds associated with the demand for foreign currency, in accordance with the requirements of Law No. (2) of 2005 on Combating Money Laundering and its Executive Regulations."

Dabaiba explained that focusing on public spending to control demand for foreign currency "has not and will not lead to any solutions to controlling the trade balance," considering it "represents a small part of the problem, and not the main problem, which is attributable to the banking system, especially with the continued rise in commercial banks' deposit liabilities, which are directly linked to money creation."

He pointed out that "the pursuit of financial balance and stability by exercising the necessary professional due diligence on the sources of funds that demand foreign currency falls on the Central Bank of Libya," considering that "the absence of this disclosure exacerbates the problem and hinders the real solutions to controlling the trade balance that the state seeks to achieve."

The Prime Minister of the Government of National Unity concluded his letter to the Governor of the Central Bank by stating that the country is "going through a critical phase that requires a serious stance to address these issues," calling for "taking the necessary measures to address them, ensuring full transparency in financial data related to foreign currency, and submitting a regular and periodic statement of the assets and liabilities of the Central Bank of Libya at the end of the last day of each month directly to the Council of Ministers, in implementation of the provisions of Article (24) of Law No. (1) of 2005 regarding banks."

...(LANA) .....