The National Oil Corporation responds to the Central Bank’s statement regarding the decline in the value of oil revenues for the year 2024

Pulbished on:

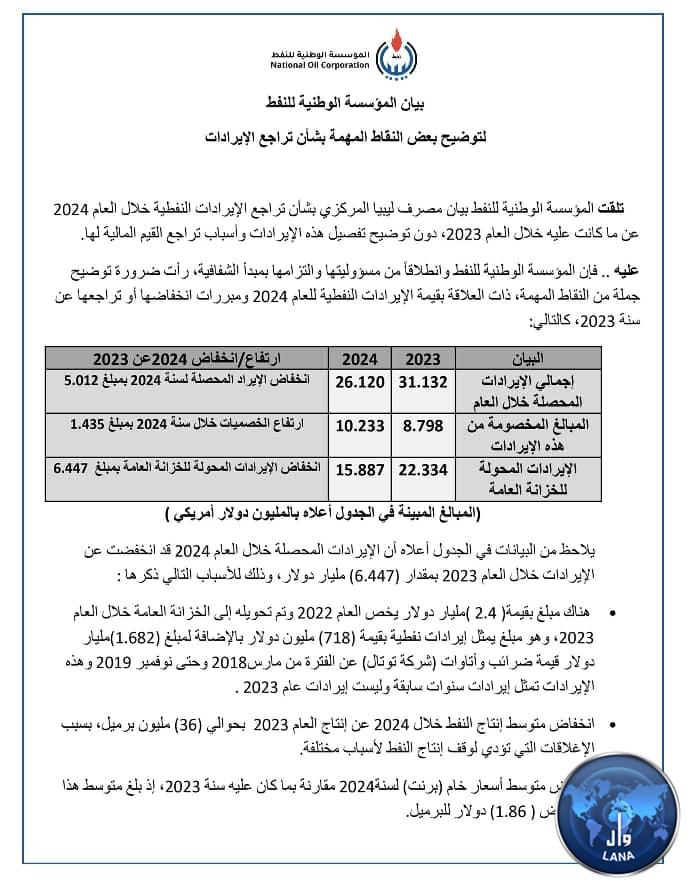

Tripoli, January 15, 2025 (LANA) - The National Oil Corporation attributed the decline in the value of oil revenues for the year 2024 compared to the year 2023 by an amount of (6.447) billion dollars, to several reasons, including the payment of taxes and royalties for previous years, the decline in average oil production in 2024 as a result of closures, the decline in average Brent crude prices, the increase in the value of fuel supplies from abroad, and the increase in expenses associated with covering the supply of fuel.

This came in a clarifying statement issued by the Corporation today, Wednesday, in response to the statement of the Central Bank of Libya regarding the decline in oil revenues during the year 2024 compared to what they were during the year 2023, without clarifying details from the bank about these revenues and the reasons for the decline in their financial values.

The reasons and justifications of the Corporation for the decline in revenues for the year 2024 or their decline by an amount of (6.447) billion dollars compared to the year 2023 were as follows.

1 - There is an amount of (2.4) billion dollars for the year 2022 and it was transferred to the public treasury during the year 2023, which is an amount representing oil revenues of (718) million dollars in addition to an amount of (1.682) billion dollars in taxes and royalties (Total Company) for the period from March 2018 to November 2019. These revenues represent revenues from previous years and not revenues for the year 2023.

2 - The average oil production during 2024 decreased from the production of the year 2023 by about (36) million barrels, due to closures that lead to the cessation of oil production for various reasons.

3 - The average price of Brent crude oil decreased for the year 2024 compared to what it was in the year 2023, as the average of this decrease amounted to (1.86) dollars per barrel.

4 - Increasing the value of fuel supplies from abroad by approximately (500) million dollars, as a result of the increase in demand by major consumers, in addition to the repeated shutdowns of the Zawiya refinery, which required covering the deficit in local refining from alternative sources abroad, in addition to the fluctuation in gas production, which forced the institution to cover this deficit as well by replacing diesel with it, to maintain the operation of vital facilities, which increased the financial burdens on fuel allocations, especially if we take into account the purchase and supply of raw material (untreated naphtha) to operate the ethylene plant at the Ras Lanuf complex for the year 2024.

5 - Increasing the expenses associated with covering the supply of fuel to cover the local market by an amount of (100) million dollars for the year 2023, including covering debts for previous years worth (40) million dollars.

6 - Supplying shipments of natural gas worth an estimated (199) million dollars, in implementation of the Cabinet decision.

7 - Increasing gas settlement allocations in favor of Eni in 2024 by approximately (447) million dollars, compared to 2023, as a result of the decline in gas production on the one hand, and the increase in the local market consumption rate of gas on the other hand, which limits the remaining quantities for export.

The National Oil Corporation confirmed in its explanatory statement that this decline in revenues was not the result of mismanagement or misjudgment by its officials and in its affiliated companies, fields and facilities, but rather the result of circumstances and developments beyond everyone's control by all standards.

At the end of the statement, the Corporation renewed its commitment to the principle of transparency and disclosure at all times, and that it does not and will not conceal data and information related to the wealth and livelihoods of the Libyan people, regardless of the circumstances, indicating that its doors are open to journalists and media professionals affiliated with official media institutions, to verify this data and the possibility of publishing it through their media platforms whenever necessary, after coordination with the Corporation's media department and its official spokesperson.

(LANA)